Navigating Insurance Claims: Your Professional Guide to a Smoother Process

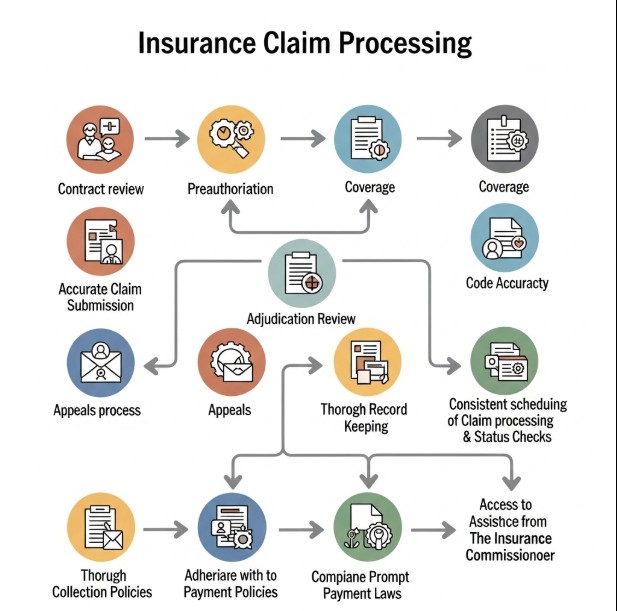

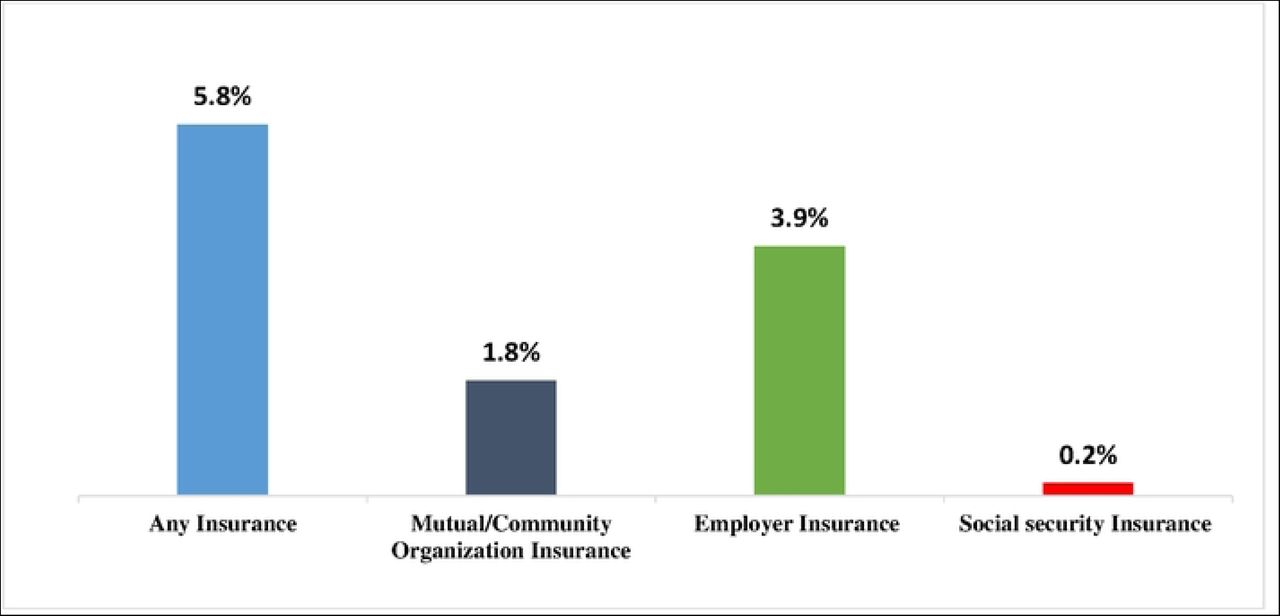

The specific circumstances of the occurrence, complex local, state, and federal laws, new technology, shifting consumer demands, and the type of insurance coverage itself are just a few of the numerous factors that affect any particular claim. Lack of instruments to holistically coordinate an equally vast range of parties engaged in every claim has hindered … Read more