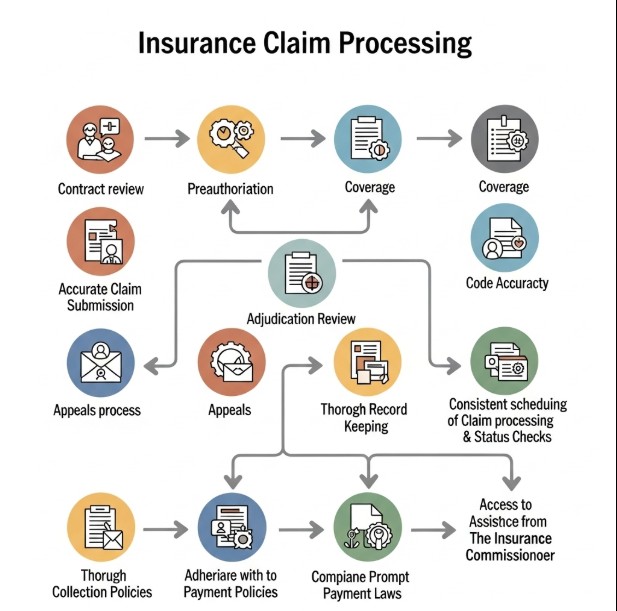

Here are a few strategies to guarantee that your claims are processed accurately and prevent payment delays:

Prior to rendering services

- Examine the terms of your health plan contract, including the requirements for filing claims, preauthorization, the fee structure, and the adjudication procedure.

- If necessary, obtain preauthorization, also known as precertification.

- Before beginning treatment, confirm if the service is covered by the patient’s insurance. Inquire with the business about any restrictions or limitations, including the number of visits or session duration.

When filing a claim

- Make sure all claim filings are exact and comprehensive by using the necessary forms.

- Comply with the payers’ specifications for submitting claims, as outlined in their provider manual or contract.

- Verify that your diagnosis and procedure codes are correct and, if required, HIPAA-compliant.

Following receipt of the adjudication notification

Examine the notification carefully to ensure it is accurate, that you were paid for the right services, that no procedure or diagnostic codes were altered, and that the amount you were paid was proper.Send a timely appeal letter to the insurance company and request a review if a claim is rejected and you feel that the denial was incorrect.

Frequently

Establish and adhere to a regular claim submission schedule. Frequently check in with the intermediary or health plan to find out the status of any outstanding claims, usually within a month of filing.

- Maintain up-to-date records of the conditions of your clients’ insurance contracts.

- Be familiar with how to access provider manuals and other contract-related documentation. There are plenty on the internet. Read newsletters and bulletins from the health plan to stay up to date on the latest information and anticipate any changes. Keep records of any modifications to your provider manual and contract.

- Recognize the collecting guidelines that different payers require. For instance, it may be fraud for providers to fail to collect copayments from beneficiaries, even when they acknowledge that there may be situations that impact patients’ capacity to pay.

Two concluding recommendations for resolving issues

- In states where prompt payment laws are enacted, psychologists may leverage these regulations to compel insurance companies to make payments within the stipulated timeframe. Generally, these laws mandate that the insurer must remit payment within 30 days upon receipt of a “clean claim,” which includes all necessary information for processing the claim.

- The office of the state insurance commissioner can serve as a valuable resource for assistance, particularly in cases where there is a recurring issue or a particularly severe situation involving a payer.